(1)ChinaBond Index Analysis

ChinaBond Composite Index tracking general performance of bond marketdropped today. The net price index excluding interest revenue declined by0.0738%; and the total return index including interest reinvested revenuedeclined by 0.0606%. In addition, the average yield to maturity was 4.5138%.The average market capitalization yield was 4.5122%. And the market valueweighted duration was 3.8383.

(2)Bond Market Performance:

Rate Securities

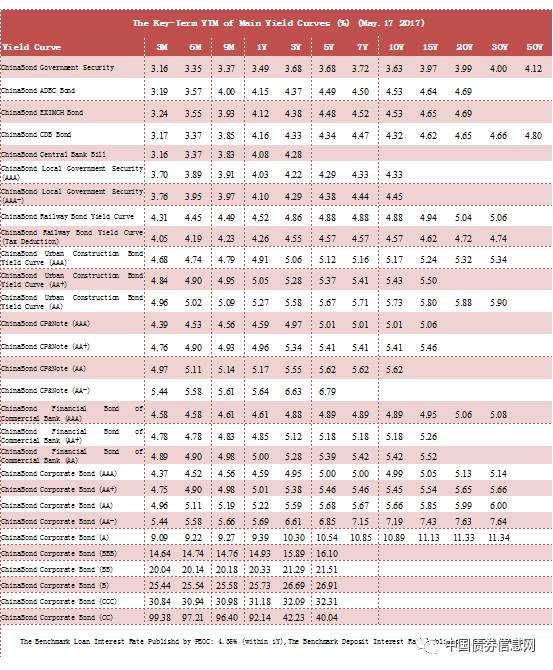

Generally speaking, the yields of Treasury Bonds and Policy Bank Bonds wavedslightly. In the morning, the auction outcome of Treasury Bonds on 3Y/7Yincreased obviously. By the end of day, the yields of Treasury Bonds went upwithin 7BPs, while the yield of CDB, EXMCH and ADBC Bonds waved within 2BPs.

To be more specific, 3Y Treasury Bonds increased 7BPs to 3.68% resultedfrom the transaction of 170008; 5Y Bonds increased 3BPs to 3.68% because of thetransaction of 170007. The yield of 7Y Bonds rose 7BPs to 3.72% according tothe transaction of 170006, while the yield for Treasury Bonds on 10Y stood at 3.63%due to the transaction of 170010.

Similarly, the yields of CDB bonds waved overall. The yield of 3Y Bond wentup 1BP to 4.33% according to the transaction 170205; referring to thetransaction of 170201, the yield for 7Y Bond dropped 1BP to 4.47%. The yield of10Y Bond reduced 1BPs to 4.32% due to the transaction of 170210.

Moreover, the yields of ADBC Bonds waved totally. The yield for 5Y Bond decreased1BP to 4.49% according to the transaction of 170409. The yield for 10Y Bond descended1BP to 4.53% referring to the transaction of 170405. The yield for 20Y Bondwent up 1BP to 4.69% because of the transaction of 160410.

Furthermore, the yield of 5Y Bonds went up 1BP to 4.48% due to thetransaction of 170304, while the yield for 10Y EXMCH Bond increased 1BP to 4.53%according to the transaction of 170303. Referring to the transaction of 150319,the yield of 20Y Bond ascended 3BPs to 4.69%

What’s more, for AAA Local Government Bonds on 1Y/8Y reached 4.03% and 4.34% accordingto the market price.

Credit Bonds

The yields of CP&Notes decreased overall. The yield for AAA 3M descended1BP to 4.39%. The yield of (AAA 6M/1Y) changed -1BP and -1BP to 4.53% and 4.59%;the 3Y of AAA went down 2BPs to 4.97%. The spot on 5Y of AAA reduced 1BP 5.01%.

The yields for Financial Bonds of Commercial Bank Yield presented mixedpattern focused by funding intense. The spot of Financial Bonds of CommercialBank on (AAA 7d/1M/3M/6M) changed 0BP, +10BPs, +2BPs and -2BPs to 3.14%, 4.09%,4.58% and 4.58%.

The yields for Urban Construction Bonds fluctuated slightly on high ratedbonds. Specifically, the yield of Urban Construction Bonds AAA on 0.5Y/3Y/5Ychanged -1BP, +1BP and +1BP to 4.74%, 5.06% and 5.12%. The yield of AA on 3Y added3BPs to 5.58%.

Exchange Market

In addition, there was 5.0 billion of transaction on exchange biddingsystem, which was scale decreased than previous. The yields of high-ratedcorporate bonds went down 1BP; those of corporate bonds and enterprise bondswith middle and low ratings added 1BP. There was active transaction for 136204,so that its yields increased as a result.

(3)Data and Statistics

Foreign Exchange Data: the intermediate value of USD/CNY quotation is 6.8635 today, with CNYincreasing by 155BPs. The intermediate value of USD/CNY had already ascendedfor 5 days, and it reached the highest value in last three months.

PBOC:the Central Bank madea series of reverse repurchase of 110 billion Yuan for 7 days and 30 billionYuan for 14 days. There was 130 billion Yuan reverse repurchase due today, andthe Central Bank made a net release of 10 billion Yuan.

SHIBOR: All terms wavedslightly today. SHIBOR 1W dropped 0.07BP to 2.8820% and SHIBOR 2W increased 0.40BPto 3.3970%,

Stock Market:The stock market wavedtoday. Shanghai composite index descended to 3104.44 by 8.52 points (-0.27%) andShenzhen component index increased to 10030.11 by 16.55 points (-0.16%). GEMindex added to 1822.64 by 7.70 points (0.42%).